LBI Oceanfront, Bayfront and LagoonFront Homes

If you have done your research on Long beach Island real estate and you are ready to move forward with your LBI waterfront home search then you can go directly to the property listing pages.

LBI Bayfront homes for sale with unobstructed bay views and LBI Lagoonfront homes for sale on the water but may have obstructed open bay views

Do you have CAFRA Questions about your Long Beach Island Real Estate Investment?

Several of my buyers and sellers have inquired about how difficult it is to expand oceanfront properties and just going to your township is no longer the answer. The state of NJ now requires a topological survey (elevation of the land/dune survey) and a completed C.A.F.R.A. (Coastal Area Facility Review Act) application.

Recently, I have been to meetings in Trenton with CAFRA department leaders and have learned a great deal. Knowledge of what can be built is a huge benefit for any seller. I would be happy to visit any LBI oceanfront property and inform you of basic state CAFRA rules on the expanded footprint that the state would most likely allow.

When looking at most older oceanfront homes, I find that the dune has built up around them. If this is the case, the state CAFRA limits expansion excessively. CAFRA permits with additional footprints add value to the oceanfront land. These permits usually take anywhere from 8 months to many years to acquire.

If you decide to keep the existing structure, enclosing a part of the existing deck area to the east, north and south of the home is considered part of footprint and there limitations per floor as well as guidelines if expanding only to the west (or what CAFRA considers the “shadow”). Of course, proper setbacks are needed, as defined by your township.

If you are thinking of buying or selling a waterfront property on Long Beach Island, call me to find out what you need to know for a smooth real estate process. You need a Realtor knowledgeable in state C.A.F.R.A. waterfront rules and regulations, procedures for applying for permits and time limits associated with permits for LBI waterfront properties.

I have been through numerous LBI Bayfront homes and LBI Oceanfront homes as they have been sold through the years. I will welcome the opportunity to show you what I can do for you in your next waterfront real estate transaction.

NJ State CAFRA rules, regulations and waterfront properties are my specialty but I pride myself with selling all properties on LBI.

Call Egon Willy Kahl at (609) 709-1020 or email me with your CAFRA questions.

Long Beach Island Oceanfront – a way of life!

Living on the waterfront is a way of life but life on the ocean is different from life on the bay. If you enjoy sunrises, beach walks, riding the surf, making sand castles and the many more activities only the beach can provide, you are at the right place to start looking for your Long Beach Island oceanfront real estate investment.

I am working with several buyers, some of whom are in the market to purchase an oceanfront property with an older house which may be used for a few years while seeking CAFRA permits and architectural designs before building new. The oceanfront lot size needs to be large enough to construct a 2,500 sq. ft. home to a 5,000 sq. ft. home. Some buyers are looking for oceanfront properties with a house that is 20 years of age or younger. If you are an oceanfront homeowner and are considering selling, please contact me to discuss possible opportunities.

LBI Oceanfront Investment Opportunities

I have established working relationships with a few builders on LBI who would enjoy the opportunity to build and pay for a new home on your oceanfront property and proportionately split the profit when sold! A different opportunity can be created if you are in a financial position to purchase an oceanfront property with an older house and partner with a local builder who would tear it down and construct new. Once more, the profit would be proportionately split. Please feel free to contact me if you have interest.

Recent average sales indicate that oceanfront properties with a tear down homes having 50 feet on the ocean are selling for approximately $1.4 million. After tearing down the old and constructing a 3,500 sq. ft. new home, the average sale price increases to $3.3 million, leaving a net profit of approximately $650,000.

Higher averages include purchasing tear downs with 100 feet on the oceanfront for $2.1 million and constructing a 5,000 sq. ft home with an average sale price of $4.7 million, leaving net profits of approximately $1,000,000. These approximations are based on a cost of $275 per square foot (some builders are quoting as low as $225 sq. ft., some as high as $325 sq. ft).

Long Beach Island Bayfront-Life on the Bay!

Living on the bay is a lifestyle. Your backyard is the bay as a playground. If you enjoy sunsets, boating, kayaking, windsurfing, water skiing & tubing, fishing & crabbing and the many more activities only the bay can provide, you are at the right place to start looking for your Long Beach Island bayfront real estate.

When searching for a bayfront home, you’ll notice lagoon front homes for sale offering a fantastic waterfront lifestyle as well. Most lagoon front properties have a dock for your fishing and boating needs but may lack the unobstructed bay views of a true bayfront home. During your property search, keep in mind that when you own a waterfront property on the bay, you will be responsible to maintain the dock and bulkhead, so you will want to inspect it prior to purchasing to see if any repair is needed.

LBI Bayfront Investment

As a professional Real Estate Broker, I feel a sense of accomplishment when helping a family find their perfect vacation home. It is a dream come true for many buyers when purchasing a second home. A vacation home is a place to escape the stress of work and instead be able to relax with family and friends. Many buyers enjoy not only summers on LBI but also weekends throughout the year. There is no better place to enjoy life than at a beach home on LBI and owning a bayfront property is a wise way to invest your money.

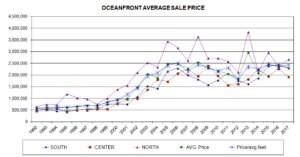

Our sales prices are once again up tremendously from last year. We have passed the previous peak season of 2005-2008 pricing! If we average the peak highest four years of data (using the years average feet pricing) our average price is $1,977,151 established from 2005 to 2008. So far this 1st half of 2018 our average price (using the years average feet pricing) is $2,088,493 which tremendously exceeds last year’s value of $1,774,984

I am working with several buyers, some of whom are in the market to purchase a bayfront with an older house which may be used for a few years while seeking CAFRA permits and architectural designs before building new. The bayfront lot size needs to be large enough to construct a 2,500 sq. ft. home to a 5,000 sq. ft. home. Some buyers are looking for bayfront properties with a house that is 20 years of age or younger. If you are a bayfront homeowner and are considering selling, please contact me to discuss possible opportunities.

27 years of LBI Oceanfront and Bayfront Home Sales Analysis

In 1987, the sales market had peaked on LBI. About six years later, I was selling oceanfront homes for approximately 25% less than the 1987 climatic sales market. Properties began appreciating slowly from 1992 to 1998. In that 7 year time period, the average oceanfront home increased approximately 24%. Over the next eight years (1999-2006), they increased another 329% and values had peaked!

We then experienced six years of a depreciating LBI oceanfront home sales market. From 2007 to 2012 values dropped approximately 27.5%. Currently, I feel these next four years values are almost back to peak, increasing approximately 22.5% from 2013 to 2016. The data that I analyze is compiled in an oceanfront and bayfront study that I created in 1992 and is published twice a year in the LBI Oceanfront and Bayfront Newsletters.

Of course, there are many other profits and expenses of owning an oceanfront home over the years. Typically rentals can gross 5% to 7% of the property’s current value each year. This income can offset many costs, including mortgages.

Since oceanfront land is so valuable, it is very common for oceanfront homes in fair condition to be torn down for new construction. These costs are not included in the studies, however can be offset by rental income. If a buyer was fortunate enough to purchase an oceanfront property at the bottom in 1992 and sell at the peak of 2006, on average that buyer would have turned each $100,000 into $429,000. If that buyer used a mortgage with 20% down, they would have turned each $20,000 into $429,000!

Timing is everything. If this historical time cycle is similar as to our last, we should begin to see great appreciation somewhere near 2020. However, no one can predict the future, and time cycles can be very different. Most buyers are excited that they are able to afford a vacation home on LBI! With attractive asking prices, along with a variety of properties to choose from, it’s a great time to buy or sell on LBI!